Palos Township Has Until August 19, 2025, to Protest Property Values

O'Connor discusses that Palos Township has until August 19, 2025, to protest property values.

CHICAGO, IL, UNITED STATES, August 18, 2025 /EINPresswire.com/ -- Cook County boasts some of the highest property taxes in the United States, thanks to a litany of issues that we have discussed before. Armed with their triennial reassessment, the Cook County Assessor’s Office (CCAO) hands out higher tax values and bills every year, just as school districts, pensions, and other government bodies raise tax rates. With the equalization factor added to the mix, property taxes are the ultimate assassin for wallets across Cook County.Unlike countless other townships in Cook County, Palos has been spared the worst of the property value hikes that have struck the rest of the state. In 2024, residential values only increased by 0.5%. This number did not rapidly increase in 2025 either, reaching only 1% growth. These halcyon days are about to end, however, as reassessment is set for 2026. This has historically brought value hikes as high as 30% or more. The best way to prepare for this coming disaster is to begin using property tax protests to lower the values in anticipation, building a solid foundation for future reductions. O’Connor will discuss what increases Palos Township taxpayers have already experienced and how appeals can protect them in the future.

Palos Township Homes Increase 1% in Value

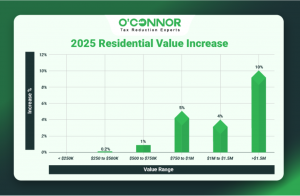

While many townships have been hit hard outside of reassessment, Palos has managed two years of minimal growth. Between 2024 and 2025, the total value for homes grew 1%, going from $6.10 billion to $6.14 billion. This was around inflation, which is rare for Chicago-area home increases. This was on top of a small uptick of .5% from 2024. Palos Township had suffered a mighty blow thanks to reassessment in 2023, so those two years acted as a much-needed breather.

When homes are categorized by worth, we see that these increases were not uniform. The three largest subsets of homes saw almost no measurable gain. The largest category, those worth between $250,000 and $500,000, only saw an increase of .25%. With a total value of $1.38 billion, homes worth less than $250,000 were in second place. These modest residences saw a miniscule increase. The No. 3 category, homes worth between $500,000 and $750,000, totaled $1.01 billion, which was an increase of 1% from 2024.

Large homes did see significant increases. Those valued between $750,000 and $1 million jumped 5% in one year. Residences worth between $1 million and $1.5 million jumped 4%, reaching a total of $102.42 million. The biggest homes in Palos Township saw a huge spike of 10%, bringing them to a combined value of $100.17 million. One positive is that 2025’s value surge was mostly targeted at taxpayers with larger budgets, helping spare the average homeowner.

In the Shadow of Reassessment

While most homeowners in Palos Township got rare stable valuations in 2025, many parts of Cook County were not so lucky, perhaps foreshadowing what 2026 has in store for the area. Elk Grove was with a spike of 26% in residential value, while Maine saw a leap of 25%. Northfield was wracked with some of the worst increases of 2025, reaching 30%. Evanston was one of the least inflated townships but still saw a bump of 23%. All of these are surges to the total value, many subtypes experienced far larger jumps, without considering the hits that some individual properties took. This is not even taking into account some of the truly massive spikes that commercial property has seen, some being over 50%.

Palos Commercial Property Rises 5%

The CCAO is supposedly attempting to protect homes from radical increases by putting more burden on businesses, though whether this is true or not is debated. 2025 has seen more aggressive increases on business properties across Chicago, so there may be some merit to the policy. This has been seen even in townships outside of reassessment, and Palos looks to be no exception.

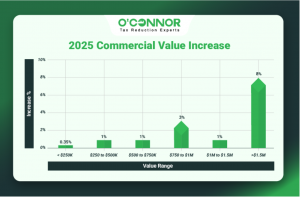

Businesses saw their taxable value jump 5% in 2025. This was stacked with a 2024 gain of 8% to make for a strong surge across the board. Commercial property totaled $828.86 in 2025, with $450.14 coming from businesses worth over $1.5 million. Larger commercial properties tend to be the main source of value and this was certainly true in Palos. These mega properties added 8% in value, making them the main engine for the overall spike in value.

Outside of the top-tier businesses, increases were small. Those worth between $1 million and $1.5 million saw a small bump of 1%, while those worth between $750,000 and $1 million increased by 3%. Commercial property worth between $250,000 and $750,000 increased by just 1%, while the smallest grew by just .35%. These rises were universally behind those seen in 2024.

Now is the Time for Appeals

Many taxpayers do not consider appealing their values until they receive huge tax bills. While this is understandable and is the main reason that protests are reaching record highs across Illinois, this is missing a vital use for appeals. Protesting taxable value in years where things are low can act as a preventative measure. If appeals in a lower-value year can lock in a property’s true worth, then this can be spun forward in years to come. Having an established baseline helps proof against future increases, specifically those brought on by reassessment.

Palos Township has only one year left of grace, before the CCAO comes back aground with their reaper’s scythe. If a taxpayer can use this current situation to establish a pattern of value, then this can hopefully be parlayed into a strong defense in 2026. If nothing else, a well-crafted appeal in 2025 might reverse some of the gains that CCAO assessed in the past few years. There is no risk to appeals, and they are now encouraged in their use even by CCAO themselves.

Appeal Deadline is August 19, 2025

There is not much time left to be prepared for your appeal. The final chance is currently set for August 19, 2025. There was a previous protest period, which closed in May. This was dedicated solely to informal appeals with the CCAO in an attempt to lower taxable value. This new deadline is for the Board of Review (BOR), which is an impartial group that does formal hearings. BOR hearings are at levels never seen before and Cook County residents are using them to achieve record reductions. The BOR has heavily been favoring homeowners, making this an especially tempting time for people trying to protect their residences.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, Texas, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.